Gold

(electronics, medicine, jewelry),and as a store of value (for both investors

and central banks).

Gold Key Features:

Gold has several different sources of demand, both as a physical metal (electronics, medicine, jewellery), and as a store of value (for both investors and central banks). As an investment, gold is seen as a safe haven, meaning it often rallies during periods of uncertainty. Gold is both pro-cyclical and counter-cyclical. Investment drivers tend to heavily influence short- and medium-term gold price performance, while long-term price dynamics respond to consumer demand, long-term savings, central bank demand, and changes in supply.

Gold tends to recover its value quickly through economic downturns, as investors withdraw cash from the market to put into a physical store of value, and its price often moves in the opposite direction to the market or economic swings. Gold is also a haven in times of inflation, as it retains its value much better in real terms than currency-backed assets. There are thus several groups of factors that influence the gold price:

- Currencies – the strength and weakness of the US dollar and other dominant currencies

- Economic growth and market uncertainty – inflation, interest rates, income growth, consumer confidence, tail risks

- Tactical flows – price momentum, derivatives positioning

- Additional gold demand and supply dynamics – mine production, idiosyncratic demand-side shocks

Key Applications:

- Jewellery

- Finance and Investing

- Electronics and Computers

- Dentistry and Medicine

- Aerospace

- Medals and Awards

Leading Gold Producers (2020):

- Newmont

- Barrick Gold

- AngloGold Ashant

- Polyus

- Kinross Gold

Key End Markets:

Gold demand is spread across four main sectors. According to Statista, in 2019 jewellery made up 48.5% of global demand, the investment sector 29.2%, central banks 14.8%, and the technology sector 7.5%. Global gold demand hit an 11-year low in 2020 at 3,759.6 tonnes as reported by World Gold Council (WGC), mainly due to a weak October-December quarter and Covid-19-related disruptions across the world muting consumer sentiment throughout the year. Global gold demand dropped 28% year-on-year to 783.4 tonnes in the fourth quarter of 2020, compared to 1,082.9 tonnes during October-December 2019. The report further revealed that global gold jewellery demand fell by 34% to 1,411.6 tonnes in 2020, down from 2,122.7 tonnes in 2019.

Supply Characteristics:

Global production of gold in 2020 was 3,200 tonnes, and it was mainly mined in China, Russia, Australia, Canada and the United States. USGS estimated worldwide gold reserves at 53,000 tonnes in 2020, with the majority in Australia, Russia, the United States, South Africa, Peru and Indonesia.

The World Gold Council’s report states that total gold supply fell 4% in the first quarter of 2021, despite a 4% increase in mine production. The overall decrease in supply in the first quarter illustrates the importance of recycling and producer hedging to the gold market. With the gold price more than 10% below its all-time highs, and the available supplies of old gold jewellery already having been sold in reaction to the strong uptick in the gold price to the August 2020 peak, recycling fell 8% year-on-year and 17% quarter-on-quarter. Producer de-hedging of 25.0 tonnes in 1Q21 contrasts with 34.7 tonnes of new hedging in 1Q20, and together these sources of supply offset the fact that mine production increased to a record level for the first quarter of any year. Looking ahead, annual mine production looks set to hit a new all-time high in 2021, barring unexpected disruptions, but recycling is likely to remain subdued.

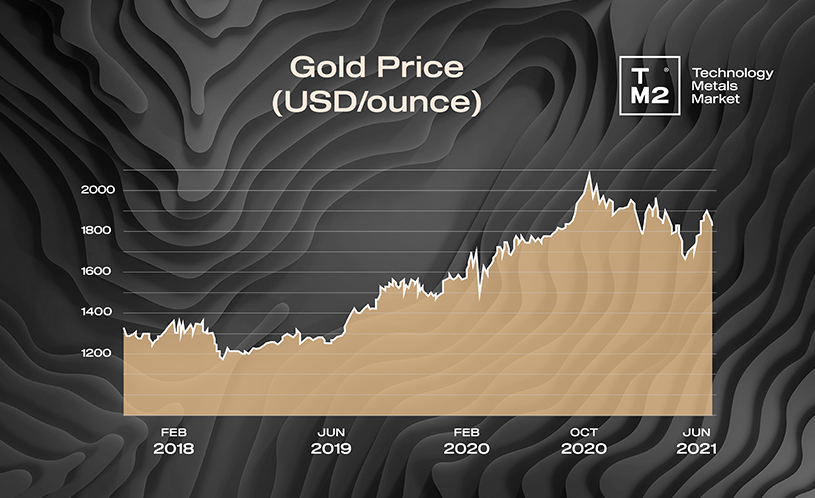

Gold Price Dynamics:

In 2020, as investors looked to gold as a safe investment during the Covid-19 uncertainty, the gold price increased from a low of US$1,480/oz in March to US$1,858/oz at the end of the year, up 25.6% year-on-year. Gold prices then fell significantly in 1Q21, from US$1,940/oz in early January to US$1,685/oz, driven by a drop in financial investment demand due to rising US real yields. According to the World Bank Commodity Market Outlook, the yield on 10-year Treasury Inflation-Protected Securities rose from -1% in January to -0.66 % in March—its highest level since June 2020. Higher real yields make gold less attractive to investors. Gold-backed exchange-traded fund holdings have also fallen sharply in recent months, and central banks have reduced gold purchases. However, from the beginning of April, gold prices started rising again, reaching US$1,900/oz in late May, and at the time of writing (16.06.2021) gold is at US$1,860/oz. Physical demand is recovering from a substantial decline in 2020, but remains well below pre-pandemic levels. On the supply side, mine production is rebounding from Covid-19 shutdowns, and should expand through 2022, as prices are well above production costs. Gold prices are expected to average 4% lower in 2021, and ease further in 2022. The World Bank Commodities Price Forecast expects the price of gold to decrease to US$1,700/oz in 2021 and to US$1,600/oz in 2022.

Key influential points:

- COMEX futures net positioning rose 10% off the March low showing higher price expectations

- Outflows from gold ETFs continued, but slowed considerably in April to less than a fifth of those seen in March

- China gold investment activity was muted in April, as reflected in lower local trading volumes, but jewellery demand could receive a boost from postponed weddings

- Surging Covid cases in India are raising concerns that the demand recovery seen in Q1 will slow

- Inflation concerns and the direction of central bank rates remain an important driver of gold prices, while rising Covid cases could weigh on consumer demand but support investment

Forecast:

The Heraeus Precious Forecast 2021 expects total gold supply to recover in 2021. Pandemic-related mine closures affected global mine production last year, but recycling flows were robust given the high price and economic difficulties. With higher gold prices anticipated this year and ongoing economic stresses, recycling levels could remain similar. Central banks should remain buyers in 2021, but without China or Russia (which stopped purchases in 2019 and 2020, leaving Turkey as the only significant gold purchaser), the total is likely to be similar to last year.

Heraeus projects the gold price to remain high in 2021, driven by the jewellery and investment industries. Of the two largest jewellery markets, China was less impacted by the pandemic than India. Downside risks to global economic growth mean governments and central banks are likely to continue their significant fiscal and monetary support, thus investment demand should also continue to lift the gold price as investors seek a safe haven and protection from inflation, a steepening yield curve and negative real interest rates. Heraeus expects gold to trade in a range between US$1,760/oz and US$2,120/oz during 2021.