Tantalum

Tantalum Key Features:

Tantalum is a very dense silver-grey metal with impressive ductility, high melting point and the ability to resist corrosion. Tantalum is one of the five major refractory metals and an important industrial commodity. Due to its high thermal conductivity, about two-thirds of tantalum is used in electronic capacitors, a fundamental component of cellphones and other modern technologies. Tantalum’s high melting point and corrosion resistance are also critical properties in superalloy manufacturing. Because it is inert in human bodies the metal is also used in surgical procedures such as orthopedic implants, connectors for torn nerves and as a binding agent for muscles. Also, its superior corrosion resistance is equivalent in performance to glass. It possesses high reliability, low failure rates, remains operational over a wide temperature range (-55°C to 200°C), and can withstand severe vibrational forces. Both the European Union and the United States classify tantalum as a critical raw material due to its technological relevance and the risk of potential supply disruptions.

Key Applications:

- Capacitors

- Engine Turbine Blades

- Semiconductors

- Chemical Processing Equipment

- Medical Surgery

Key Players:

- Global Advanced Metals Pty Ltd

- AMG Advanced Metallurgical Group

- Pilbara Minerals

- Ningxia Orient Tantalum Industry Co. Ltd

- Alliance Mineral Assets Limited.

Key End Markets:

The primary application of tantalum is in capacitors for consumer electronics. Tantalum is highly conductive of heat and electricity, and this property has made it the material of choice for electronic capacitors. In addition, the ability of tantalum to form an extremely thin oxide coating that acts as a protection layer makes its involvement inevitable in the production of small, high-quality capacitors. Wire and powder are the most used forms of tantalum for the production of capacitors. Tantalum capacitors have the highest capacitance (the ability to hold electrical charge) per unit volume of any capacitor and are used extensively in miniaturized electrical circuitry. As the market moves to greater miniaturization, the tantalum capacitor finds increased application in space-sensitive and high-end applications in telecommunications, data storage, and implantable medical devices. The use of tantalum capacitors with polymer cathode systems continues in the consumer electronics market, with rapid adoption in notebook and desktop computer applications. During the past decade, polymer tantalum capacitors have gained popularity in medical, avionic, and military designs. Today, manufacturers of polymer tantalum capacitors have set their sights on the automotive industry as the next area of growth.

Rwanda, DRC, Brazil, Mozambique, Nigeria are the top producing countries in the world. Global tantalum production in 2020 was lower due to temporary mine closures in Brazil and Rwanda caused by the COVID-19 pandemic in comparison with 2019 . Continued low prices for tantalum was also a factor. In Australia, lithium mines that had produced tantalum as a byproduct in 2019 remained on care-and-maintenance status in 2020 because of continued low prices for lithium. Production in Congo (Kinshasa) was estimated to have increased in 2020 based on reported ore production through August 2020 with China as the main export destination. Brazil, Congo (Kinshasa), and Rwanda accounted for 77% of estimated global tantalum mine production in 2020.

Price Trends

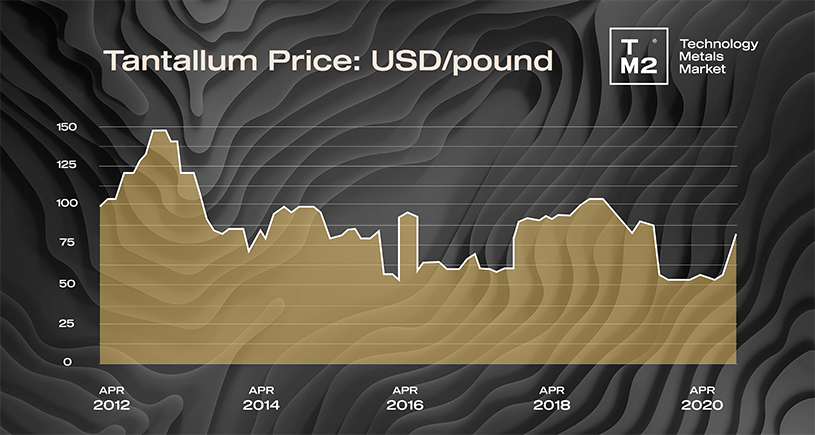

There are no official prices for tantalum, as this metal is not traded on any metal exchange (London Metal Exchange or other). The price is determined solely by negotiation between buyer and seller. Some price data may be found in metal articles or in publications, whether printed or on the internet. Examples of such press include Asian Metal, Argus, Platts and CRU Prices Service, which regularly publish subscription-based information on market prices. The Raw Materials report for Passive Components from Tii.com provides the tantalum price chart from April 2012 to April 2020 referring to Paumanok Monthly Market Research Report.

According to the Argus Media group, Tantalum metal prices in Europe rebounded sharply in May and early June 2021 on rising raw materials costs, higher freight rates and small signs of a demand recovery from the superalloys sector. Tantalum prices probably have the potential to remain supported in the near-term by strong supply and demand fundamentals with bullish sentiment in the global economy, according to Argus Media group. Argus' assessment for 99.8% tantalum metal has risen to a two-year high of US$275-285/kg due to restrictions related to unpaid duty in warehouse Rotterdam, its highest since May 3 2019 assessment of US$270-290/kg. The price increase came on the back of soaring tantalite ore prices, which also hit a two-year high in May, because of strong demand from the consumer electronics sector, coupled with tightness in supply from ongoing logistical constraints.

Tantalum prices had found support earlier in the year from supply tightness and concerns about obtaining material during the Covid-19-related lockdown in Rwanda. No tantalum mines were allowed to operate during the lockdown in the country, which accounts for the majority of global tantalum output. Tantalum prices are now trading around their highest level since the beginning of the year. Meanwhile, demand for tantalum is likely to continue to rise, with the electrification of homes and the increasing adoption of the Internet of Things (IoT) and 5G communications technologies.

Tantalum price chart, US$/oz:

Forecast:

According to Mordor Intelligence, the tantalum market was valued at around 2.3 kilotons in 2020, and the market is projected to register a CAGR of 6% during the forecast period (2021-2026). COVID-19 has halted the growth of several metal markets all around the world. With the restrictions around the world and mining activities halted in almost every major region the production and trade of tantalum were adversely affected. Thus, manufacturers were facing continued downward pressure on demand and revenues due to the COVID-19 pandemic. Additionally, the impact of COVID-19 on supply chains has also delayed the implementation of 5G on a short-term basis. However, some of the key players are mainly focusing on research and development to provide innovative products to introduce to the market, thus, boosting the market studies.

Over the short term, major factors driving the market studies are the growth from the electrical and electronic industry and extensive usage of tantalum alloys in aviation and gas turbines. Replacement of solid capacitors with polymer tantalum capacitors is likely to act as an opportunity in the future. In the short term, as 5G is rapidly growing, the need for tantalum will increase. Asia-Pacific dominates the world market , with the largest consumption coming from China and South Korea.